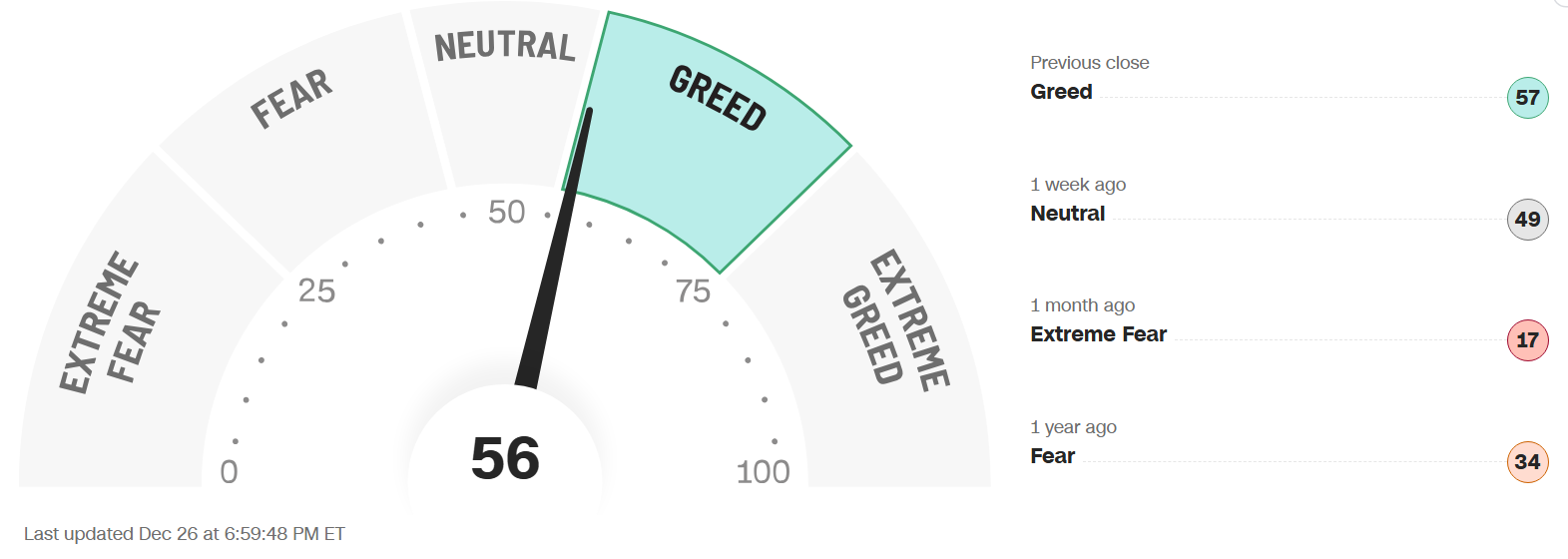

Fear & Greed Index 56

Weekly Update

The Fear & Greed Index (found on cnn.com) is one of the easiest indicators to use to determine current market emotion. This simple to read gauge, highlighted in our publication When to Buy and When to Sell: Combining Easy Indicators, Charts, and Financial Astrology (available on Amazon), is measured in a range from 0-100, and currently reads 56 as of the close on Friday, December 26, 2025.

This figure moved just into the edge of the Greed level, after rising 11 points from last week’s close of 45, as markets gradually rose Monday through Wednesday. This was reflected in the S&P 500, as it rose 95 points, from 6,834 to 6,929, as it enjoyed a 5-day winning streak, before losing a mere 2 points on Friday. There continues to be lower than average trading volume however, restricting any conviction of bullish or bearish movements.

Despite the oscillating price action, the 4 major indexes (S&P 500, Nasdaq, Dow Jones Industrial, and Russell 2000), continue their internal bullish sentiment regarding their 200-day moving averages. All remain in healthy low 60’s% range, with the DIA continuing to lead at 70%. Each index’ shorter-term 20 and 50-day MAs also remain in bullish territory, though the IWM Small-Cap index has slipped of late, now sitting at only 51% on the 20-day. The seasonal strength of December (a month where fund managers alter their portfolios to buy leading stocks) has been mixed, and we may have just seen the anticipated Santa Claus Rally, during the 5-day increase of 3.1%. Technically, this rally occurs during the last 5 trading days of the year, and first 2 of the new year (though it can shift with algorithmic trading and macro conditions) and averages a gain of 1.3%. Quarter-end window dressing remains in play as well, through this coming Wednesday (the last day of the year).

The “Risk-On” sentiment continued this week as well, in the financial and technology sectors, which usually lead bull runs. 10-year bond yields remained stubborn, closing the week at 4.13% vs last week’s close of 4.15%, suggesting the bond market is not quite convinced that the economy is in good shape. Keep in mind that the recent rate cut was “priced-in” to the market, and the Fed Chair’s comments regarding future cuts was not very convincing.

The 7 internal factors used to formulate this gauge are listed on the screen (below):

Market Momentum – (S&P 500 vs its 125-day moving avg) = GREED

Market Volatility (measured by the VIX) = NEUTRAL

Put to Call Ratio 5-day avg. (# of Puts (bearish) vs Calls (bullish) = EXTREME FEAR

Stock Price Strength (# of new 52-week highs vs new 52-week lows) = GREED

Stock Price Breadth (# of shares rising vs falling on NYSE) = NEUTRAL

Safe-Haven Demand (which measures stocks vs bonds) = GREED

Junk Bond Demand (non-govt. bond yield spread) = EXTREME GREED

This week 5 of these 7 factors changed levels, as the momentum categories all improved, and volatility remained very low. The Put to Call Ratio continues its Extreme Fear sentiment, suggesting a continuation of gains in the short term. Finally, Safe-Haven Demand, essentially commodities, has again reached the Greed levels, signified by another surge in safer investments.

The VIX, measured by Market Volatility, dipped again, closing the week at 13.6, vs. last week’s close of 14.9, as market volatility continued to decline. The crucial “20” level, has not been approached since November 24, and, as noted last week, the gauge is now reaching low levels where a reversal is probable, though not likely until after the new year, unless a Black Swan event occurs.

News this week focused on the surprising full 1% rise in GDP, reported at 4.4% vs 3.4%. Other reports were not as positive as manufacturing, durable goods orders, and consumer sentiment all declined. These mixed results have resulted in neither a crash, or surge, in the equities markets thus far.

Astrologically, Capricorn season (ruled by the planet Saturn) continues through January 19. Please see our recent Sign Language – Capricorn blog, dated 12-5-25 for full details. As the Sagittarius/Jupiter optimism and expansion of Sagittarius season (usually resulting in favorable market conditions), fades, they could be tempered by Saturn’s challenging energies.

The planet Mercury, will enter the sign of Capricorn on January 1 (through Jan 19), and is now weeks past its recent retrograde, which has resulted in lower volatility, as expected.

The planet Venus, has now entered the sign of Capricorn (Dec 24 - Jan 16), after exuding holiday cheer during its stay in Sagittarius, symbolized by the increase in retail spending. However, it has been noted that only the top 10% of the income earners are responsible for 50% of the spending activity, and the Capricorn/Saturn influence may temper that enthusiasm.

The planet Mars is also transiting the sign of Capricorn (Dec 14 – Jan 22), theoretically reducing over-aggression, and rewarding hard work and persistence. As previously noted, Mars in Sagittarius symbolized aggressive gains in the short-term, however, the recent square with the planet Saturn (which has now moved away) created a few challenges (please see our Trader Transits - Mars square Saturn blog, dated 11-29-25).

The planet Jupiter also remains retrograde in the sign of Cancer (until March 11). As previously discussed, Jupiter has very powerful expansive energies, which may weaken a bit for the time being.

Finally, the planet Uranus, which is currently in retrograde until early February, recently regressed from the sign of Gemini (communications and technology) to the sign of Taurus (money), and will not return to Gemini until April, 2026. This 6-month re-visit to the sign of money (ruled by Venus), could create more shocks to the markets, in either direction, so beware. Please review our Planet Power – Uranus Retrograde blog, dated 8-27-25 for further details.

Leading sectors, with over 50% of stocks trading over their 200-day MAs, include Financials (always needed for bullish markets) and Healthcare, while Energy, Utilities, and Real Estate continue to lag, though the additional recent rate cut is helping to turn the sector around. The Utilities decline is mainly a result of the low VIX, and “risk-on” sentiment, as it they are a safe play in difficult market conditions. Sectors of the technology industry that are likely to continue their advance into the future include AI, robotics, quantum computing, and space development (with Pluto positioned in Aquarius, and Uranus in Gemini for many years to come – when it returns in April), but will experience pullbacks along the way.

Gold (ruled by the Sun), and Silver (ruled by the Moon), rose again this week, especially silver, which has again hit all-time highs, and is now worth more than a barrel of oil! The Gold to Silver Ratio (covered in our publication), fell significantly, closing at 57.2, compared to last week’s close of 64.3, suggesting gold may be a better “value” buy at the current time. Both remain good buys after pullbacks (which they are due for) in the current economic conditions, as central banks continue to buy. Bitcoin (ruled by Uranus) decreased this week and continues its volatility (in lock-step with the Uranus retrograde back into Taurus), and remains skittish.

***As always, this information is not intended to be financial advice, or any specific buy or sell recommendation, but rather a guide to assist the reader in some further understanding of current economic conditions/movements in the sky, and how they can affect moods, behaviors, world events, and financial markets.